Real Estate Tools

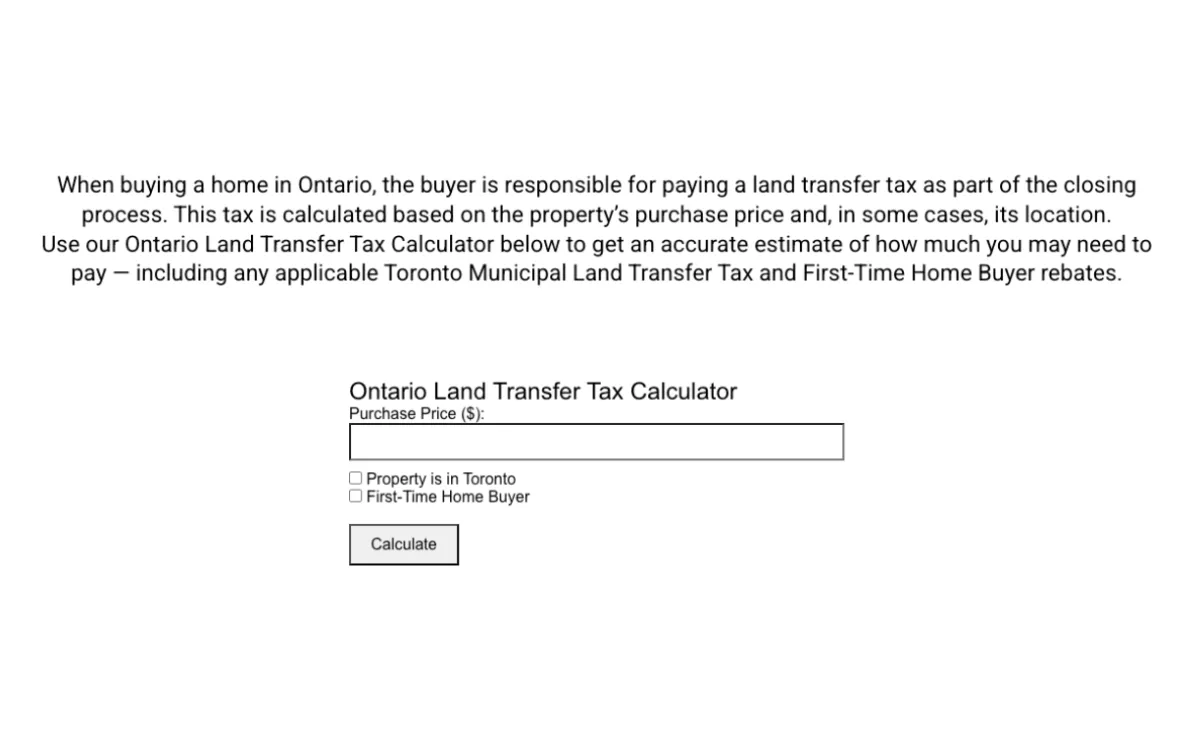

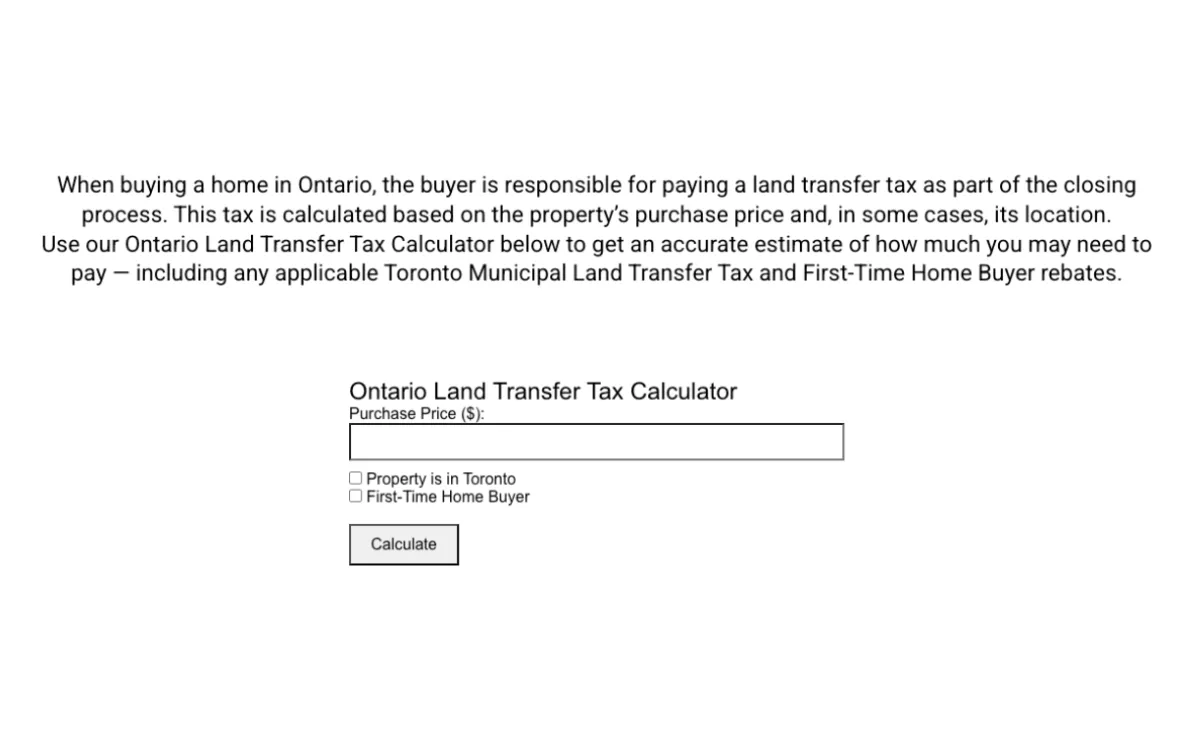

Land Transfer Tax Calculator

Instantly calculate your Ontario land transfer tax, including Toronto’s Municipal Land Transfer Tax (MLTT) if applicable. Know exactly what you’ll owe before you buy — and avoid costly surprises at closing.

What is land transfer tax in Ontario?

Land transfer tax is a provincial fee you pay when purchasing property in Ontario, calculated based on the property’s purchase price.

Does this calculator include Toronto’s extra tax?

Yes. If the property is in Toronto, the calculator automatically adds the Municipal Land Transfer Tax (MLTT) to your total.

Can I reduce my land transfer tax?

First-time home buyers may qualify for a rebate of up to $4,000 provincially, and additional rebates if purchasing in Toronto.

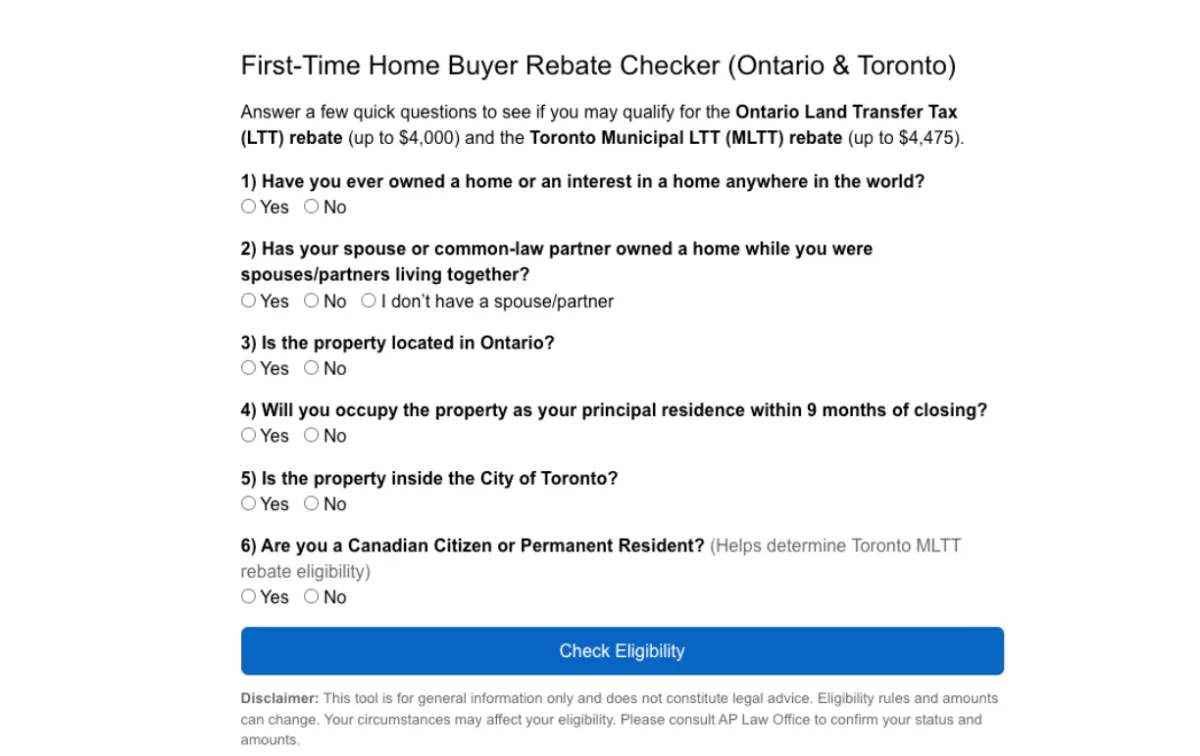

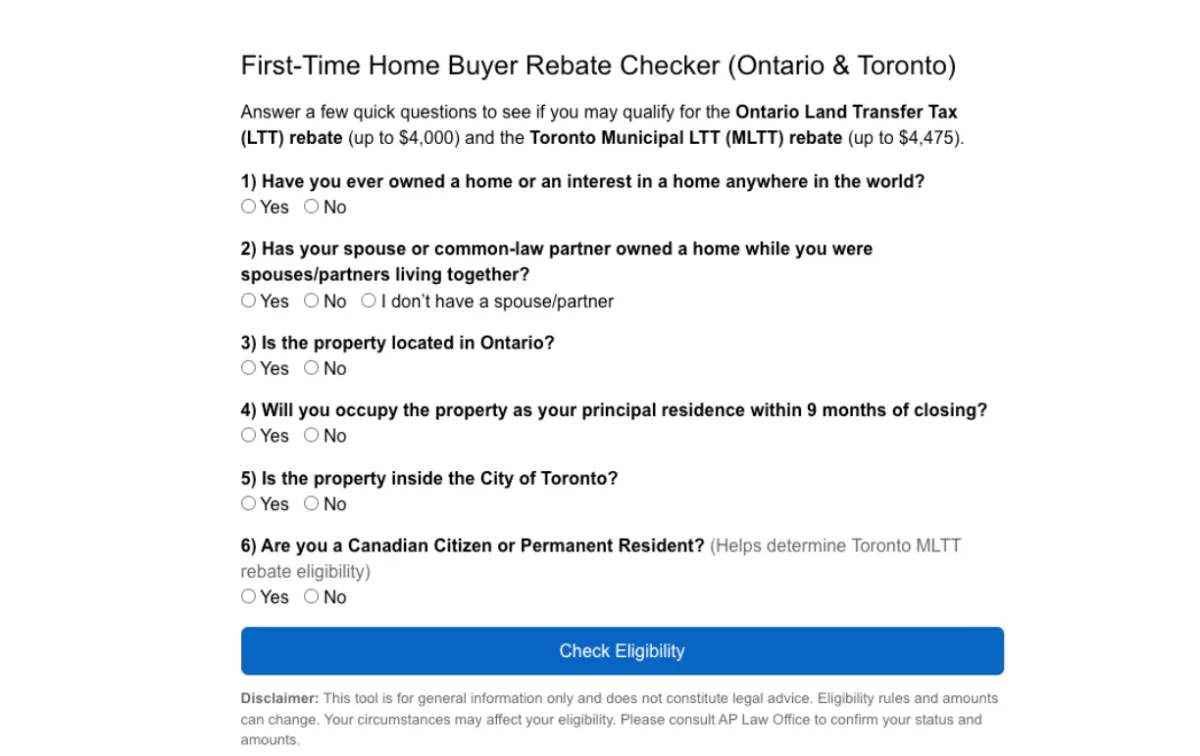

First Time Home Buyer Rebate Checker

See if you qualify for Ontario’s first-time home buyer land transfer tax rebate — and exactly how much you could save. Instantly check your eligibility and reduce your closing costs before you buy.

Who qualifies as a first-time home buyer in Ontario?

You must have never owned a home anywhere in the world, and your spouse must also meet this requirement. Use the tool to figure out if you do

How much could I save with the rebate?

Eligible buyers can receive up to $4,000 off the Ontario Land Transfer Tax, plus an additional rebate if the property is in Toronto.

Does the rebate apply to resale and new homes?

Yes. The rebate applies to both newly built and resale residential properties in Ontario.

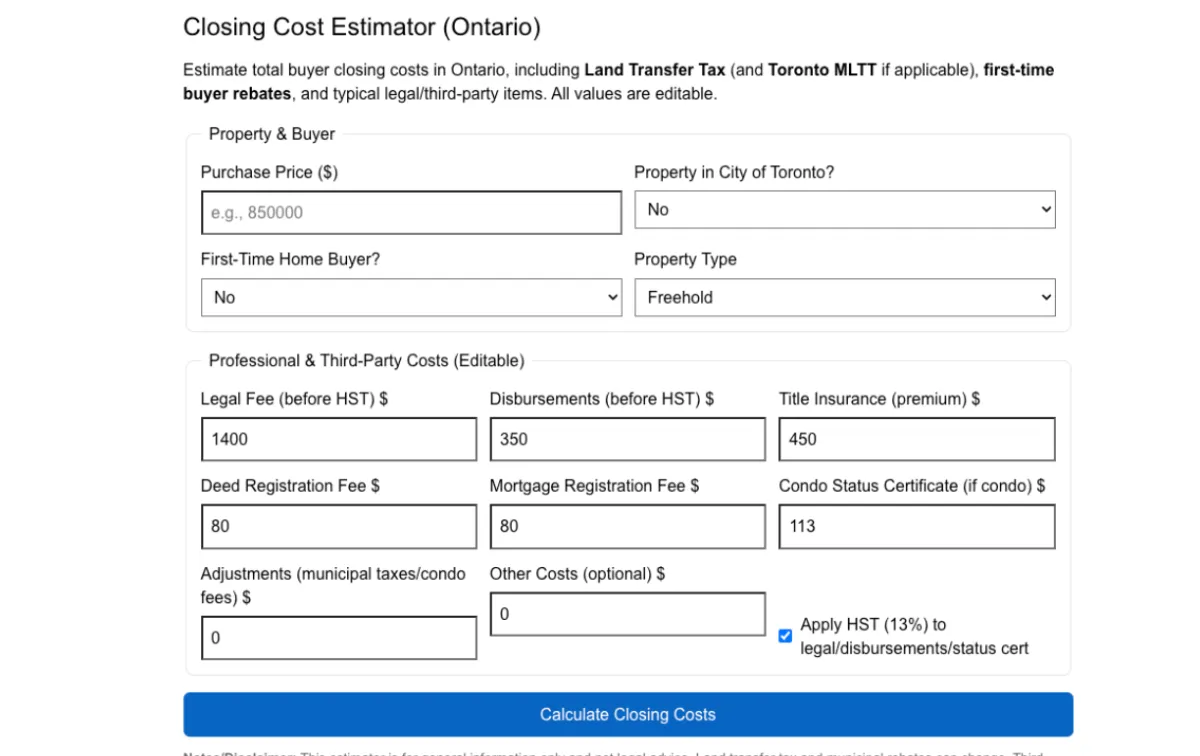

Closing Cost Estimator

Calculate your total closing costs in Ontario — including land transfer tax, legal fees, title insurance, and more. Get an accurate estimate before you buy so you can budget with confidence.

What are closing costs when buying a home in Ontario?

Closing costs are the one-time fees and expenses you pay when finalizing your property purchase, such as land transfer tax, legal fees, and title insurance.

How accurate is this estimator?

The tool provides an Ontario-specific estimate based on common cost ranges. Your actual costs may vary depending on your location, property type, and service providers.

Are closing costs the same for new and resale homes?

Not always. New homes may include additional fees like HST or development charges, which resale homes typically do not have.

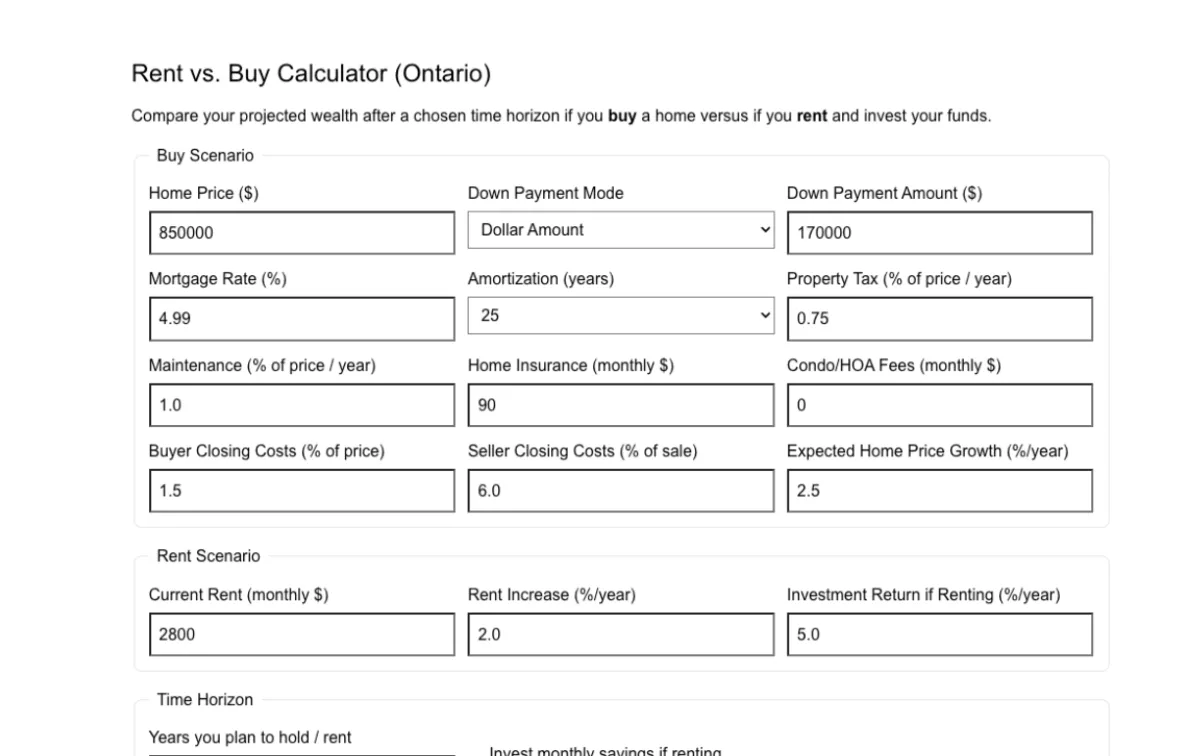

Rent VS Buy Calculator

Compare the true cost of renting versus buying in Ontario based on your budget, location, and lifestyle. See which option makes more financial sense for you — now and in the future.

How does the Rent vs. Buy Calculator work?

Not necessarily. In some markets, buying can build long-term wealth, while in others renting may be more affordable and flexible.

Does it consider future cost changes?

Yes. The calculator can project rent increases and home value appreciation to show how the financial picture might change over time.

Is renting always cheaper than buying?

Not necessarily. In some markets, buying can build long-term wealth, while in others renting may be more affordable and flexible.

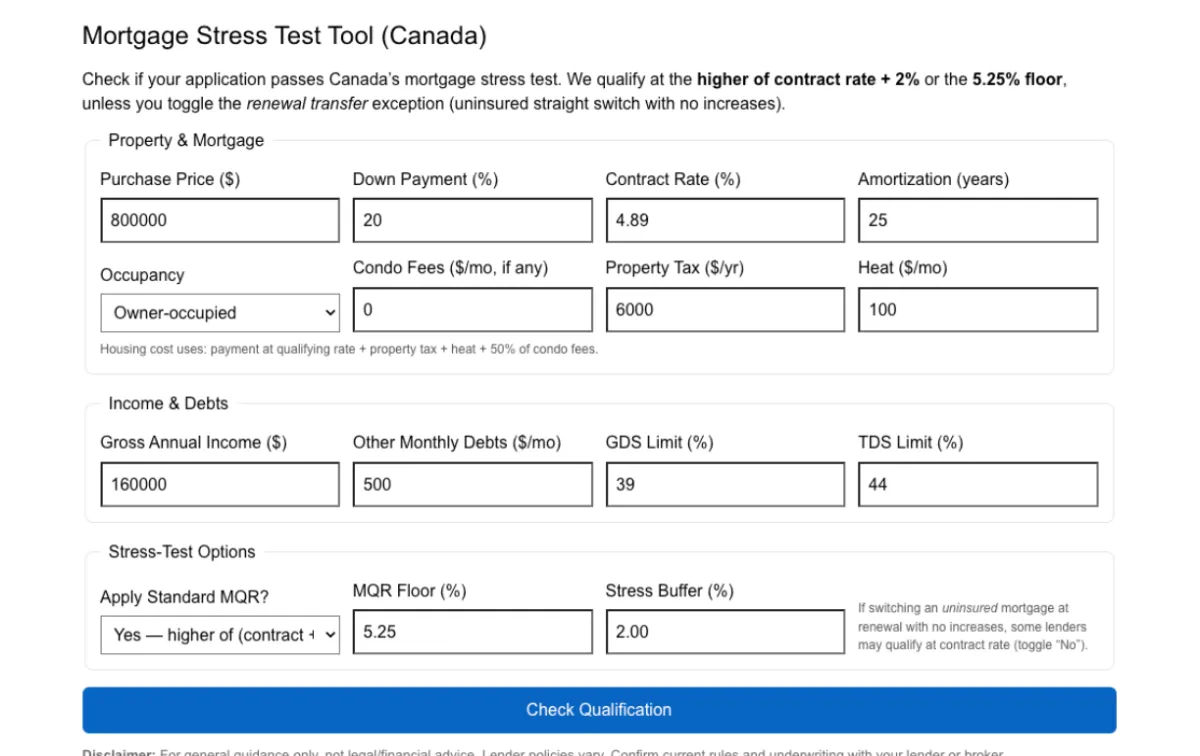

Mortgage Stress Test Tool

See if you qualify for a mortgage under Canada’s federal stress test rules. Instantly check your affordability using the higher qualifying interest rate lenders must apply — before you start shopping for a home.

What is the mortgage stress test?

The mortgage stress test is a federal rule that requires lenders to assess your ability to make payments at a higher qualifying interest rate, ensuring you can handle potential rate increases.

What rate does the stress test use?

Lenders must use the greater of the Bank of Canada’s benchmark qualifying rate or your contract rate plus 2%.

Does passing the stress test guarantee mortgage approval?

No. Passing the stress test is just one part of the approval process — lenders also consider your credit score, income, debt levels, and other factors.

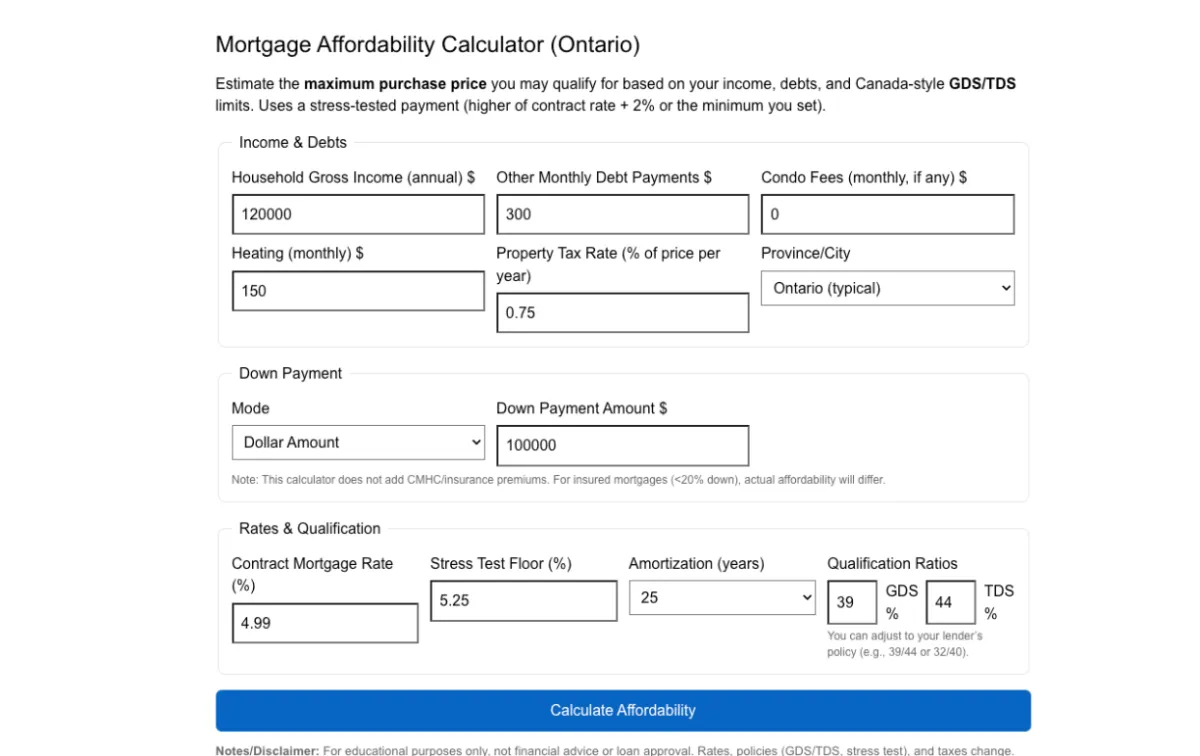

Mortgage Affordability Calculator

Find out how much home you can afford in Ontario based on your income, debts, down payment, and expenses. Get an instant estimate of your maximum purchase price before you start house hunting.

How does the Mortgage Affordability Calculator work?

It uses your income, monthly debts, down payment amount, and expenses to estimate the maximum home price you may qualify for under typical lending guidelines.

Does this calculator include the stress test rules?

Yes. It factors in Canada’s mortgage stress test by applying a higher qualifying interest rate to ensure you could handle future rate increases.

Will my bank approve the same amount this calculator shows?

Not always. This tool provides an estimate — your lender’s approval may differ based on your credit score, financial history, and their specific lending criteria.

Prepayment Penalty Calculator

Estimate how much it will cost to break your mortgage early in Ontario. Instantly calculate your prepayment penalty based on your mortgage balance, interest rate, and lender’s rules — before you make a move.

What is a mortgage prepayment penalty?

It’s a fee your lender charges if you pay off your mortgage early, refinance, or break your mortgage term before it expires.

How does this calculator estimate my penalty?

It uses your mortgage balance, interest rate, time left on your term, and common lender penalty formulas — either three months’ interest or the Interest Rate Differential (IRD).

Why should I check my penalty before breaking my mortgage?

Penalties can be thousands of dollars, so knowing the cost upfront helps you decide whether refinancing, selling, or switching lenders is worth it.

Home Equity Calculator

See how much equity you’ve built in your Ontario home. Instantly calculate your current home value minus your remaining mortgage to know your available equity for refinancing, renovations, or investments.

What is home equity?

Home equity is the difference between your home’s current market value and the amount you still owe on your mortgage.

How can I use the equity in my home?

You can access your equity through refinancing, a home equity line of credit (HELOC), or by selling your home, and use it for renovations, investments, or debt repayment.

How accurate is this calculator?

It provides an estimate based on your inputs, but a professional appraisal or market evaluation from a realtor will give a more precise figure.

Property Tax Calculator

Estimate your annual property taxes in Ontario based on your home’s value and location. Instantly see what you’ll owe and budget more accurately for homeownership costs.

How does this calculator estimate property taxes?

It uses your home’s assessed value and the municipal tax rate for your location to estimate your annual property tax bill.

Are property tax rates the same across Ontario?

No. Each municipality sets its own tax rate, so property taxes can vary significantly depending on where you live.

Does the estimate include special charges or levies?

No. The calculator focuses on base property tax rates. Additional local levies or charges may apply depending on your municipality.

Real Estate Tools

Land Transfer Tax Calculator

Instantly calculate your Ontario land transfer tax, including Toronto’s Municipal Land Transfer Tax (MLTT) if applicable. Know exactly what you’ll owe before you buy — and avoid costly surprises at closing.

What is land transfer tax in Ontario?

Land transfer tax is a provincial fee you pay when purchasing property in Ontario, calculated based on the property’s purchase price.

Does this calculator include Toronto’s extra tax?

Yes. If the property is in Toronto, the calculator automatically adds the Municipal Land Transfer Tax (MLTT) to your total.

Can I reduce my land transfer tax?

First-time home buyers may qualify for a rebate of up to $4,000 provincially, and additional rebates if purchasing in Toronto.

FTHB Rebate Checker

See if you qualify for Ontario’s first-time home buyer land transfer tax rebate — and exactly how much you could save. Instantly check your eligibility and reduce your closing costs before you buy.

Who qualifies as a first-time home buyer in Ontario?

You must have never owned a home anywhere in the world, and your spouse must also meet this requirement. Use the tool to figure out if you do

How much could I save with the rebate?

Eligible buyers can receive up to $4,000 off the Ontario Land Transfer Tax, plus an additional rebate if the property is in Toronto.

Does the rebate apply to resale and new homes?

Yes. The rebate applies to both newly built and resale residential properties in Ontario.

We strive for Customer Satisfaction. Coming from in-depth understanding of the law and the industry, capitalizing on extensive experience, we provide hands-on advice that speaks the language of our client’s needs. No matter if your case is large or small, we treat your matter with importance, integrity and hard work, your success is our satisfaction.

Contact Us

(Local | Toll Free | Email)

Local

905 - 266 - 2633

Toll Free

Email

[email protected]

Our Addresses

(Vaughan | Toronto | London)

Toronto | Mississauga | Brampton | Vaughan | Hamilton | Markham | Oakville | Burlington | Kitchener | London

This site is not legal advice. We occasionally use content and information that is prepared by AI. Including but not limited to technology from Gemini, Chat GPT, Grok, Canva, and other technologies from Open AI. Always consult with a lawyer regarding specific legal questions and advice. Give us a call at 905-266-2633 to set up a consultation

Copyright © 2025 Pranzitelli Law Firm | All rights reserved

Powered By Systems By Orukana

We strive for Customer Satisfaction. Coming from in-depth understanding of the law and the industry, capitalizing on extensive experience, we provide hands-on advice that speaks the language of our client’s needs. No matter if your case is large or small, we treat your matter with importance, integrity and hard work, your success is our satisfaction.

Contact Us

(Local | Toll Free | Email)

Local

905 - 266 - 2633

Toll Free

Email

[email protected]

Our Addresses

(Vaughan | Toronto | London)

Toronto | Mississauga | Brampton | Vaughan | Hamilton | Markham | Oakville | Burlington | Kitchener | London

This site is not legal advice. We occasionally use content and information that is prepared by AI. Including but not limited to technology from Gemini, Chat GPT, Grok, Canva, and other technologies from Open AI. Always consult with a lawyer regarding specific legal questions and advice. Give us a call at 905-266-2633 to set up a consultation

Copyright © 2025 Pranzitelli Law Firm | All rights reserved

We strive for Customer Satisfaction. Coming from in-depth understanding of the law and the industry, capitalizing on extensive experience, we provide hands-on advice that speaks the language of our client’s needs. No matter if your case is large or small, we treat your matter with importance, integrity and hard work, your success is our satisfaction.

Our Addresses

(Vaughan | Toronto | London)

Vaughan

4370 Steeles Avenue West, Suite 16

Vaughan, On L4L 4Y4

Toronto

18 King Street East, Suite 1400

Toronto, On M5C 1C418

London

341 Talbot St, Suite 333

London, ON N6A 2R5

Contact Us

(Local | Toll Free | Email)

Local

905 - 266 - 2633

Toll Free

1-844-757-HURT

Email

[email protected]

Toronto | Mississauga | Brampton | Vaughan | Hamilton | Markham | Oakville | Burlington | Kitchener | London

This site is not legal advice. We occasionally use content and information that is prepared by AI. Including but not limited to technology from Gemini, Chat GPT, Grok, Canva, and other technologies from Open AI. Always consult with a lawyer regarding specific legal questions and advice. Give us a call at 905-266-2633 to set up a consultation

Copyright © 2025 Pranzitelli Law Firm | All rights reserved