Wills & Estate Planning Tools

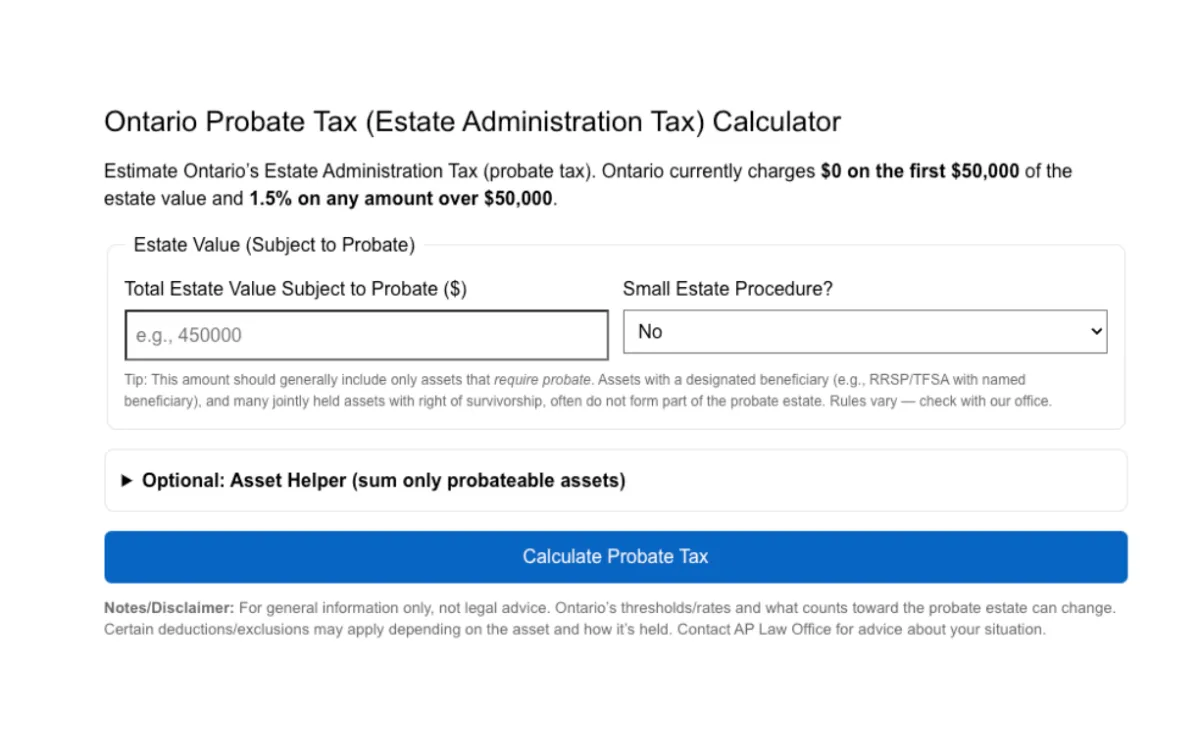

Probate Tax Calculator

Instantly estimate Ontario’s probate (Estate Administration Tax) based on your estate value. See what you’ll owe and plan ahead to reduce fees where possible.

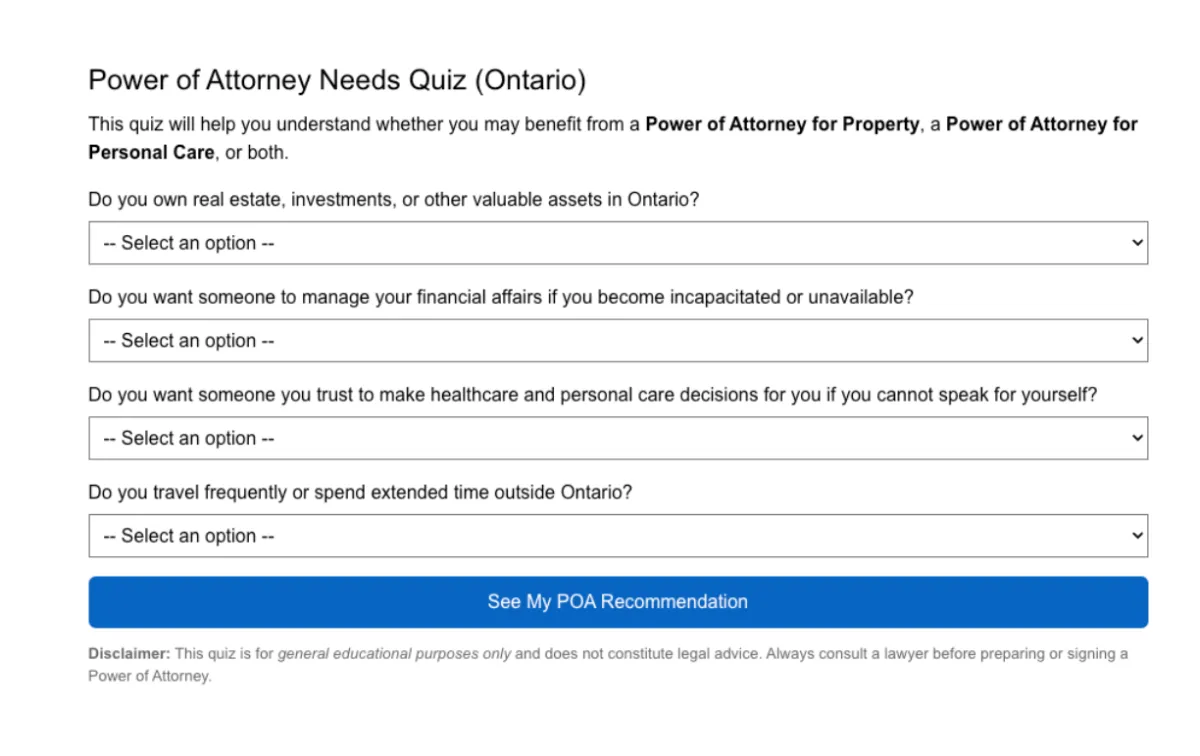

Power Of Attorney Needs Quiz

Find out which type of Power of Attorney is right for you in Ontario. Answer a few simple questions and get instant guidance on choosing the right POA for your needs.

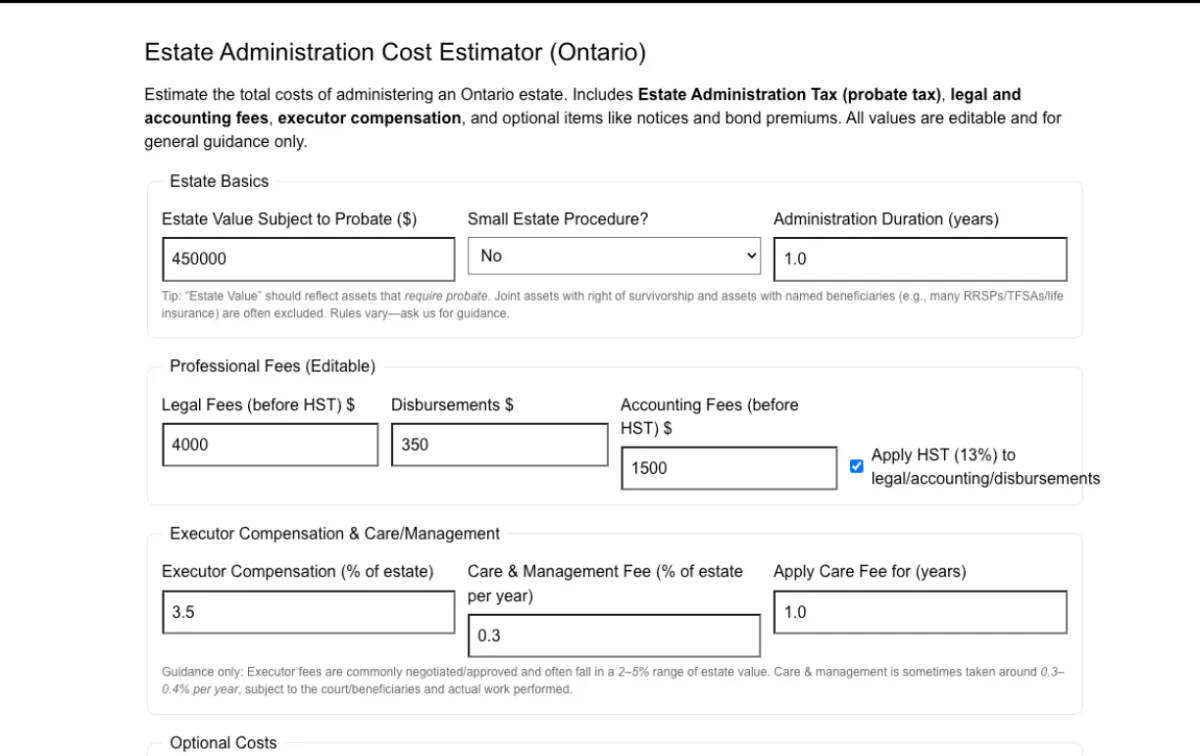

Estate Admin Cost Estimator

Estimate the full cost of administering an estate in Ontario — court fees, legal/accounting, executor compensation, and disbursements. Get a clear budget before you start probate.

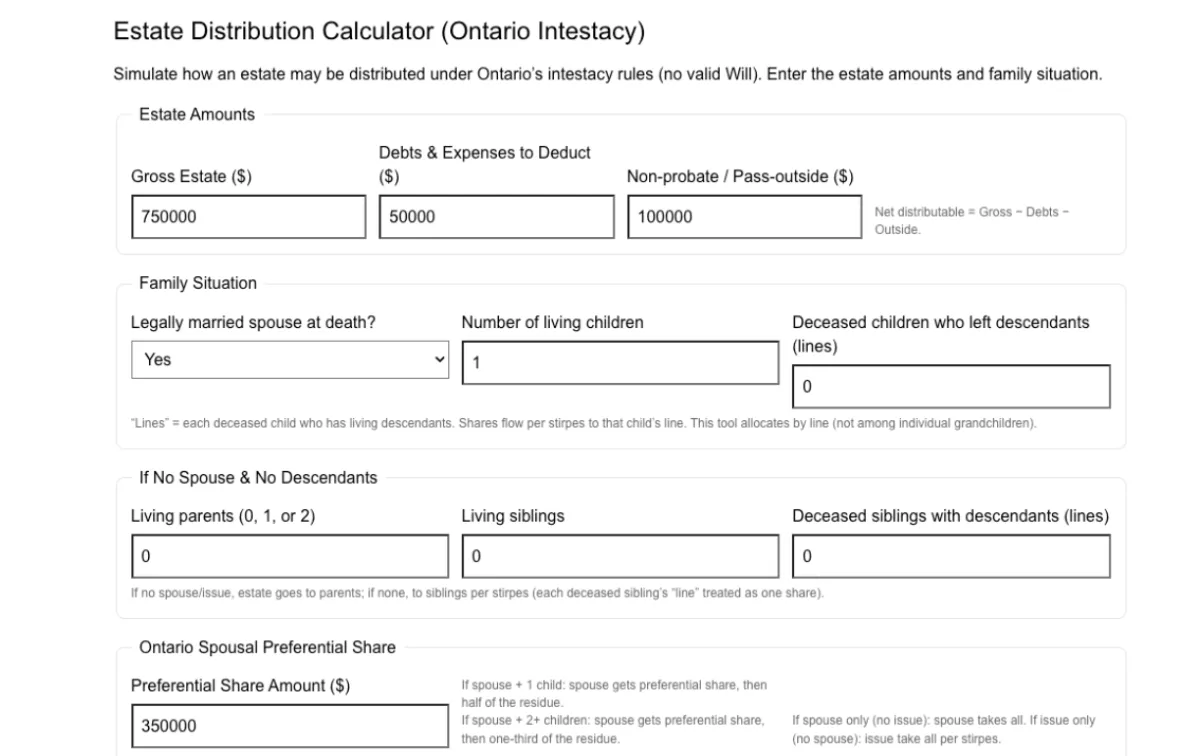

Estate Distribution Calculator

See how your estate would be divided if you pass away without a will in Ontario. Instantly simulate intestacy rules and understand who would inherit what.

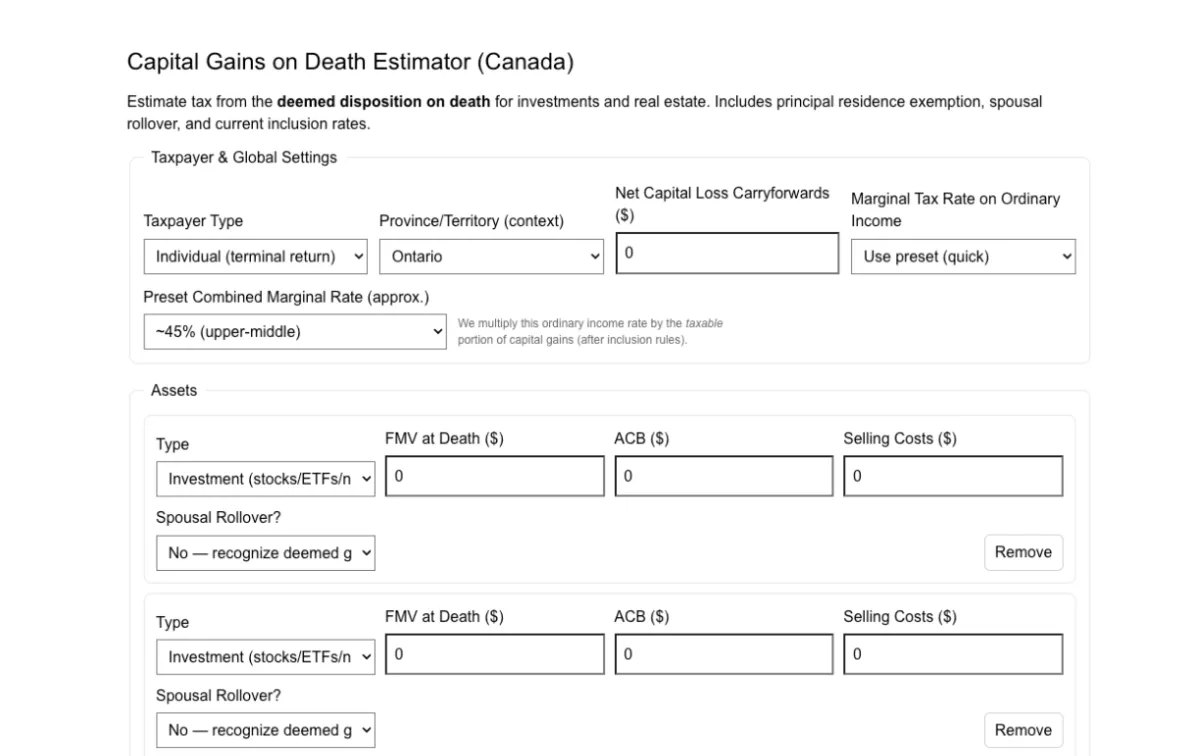

Capital Gains On Death Estimator

Estimate the capital gains tax your estate may owe on investments and real estate at death. Plan ahead to minimize taxes and preserve more for your beneficiaries.

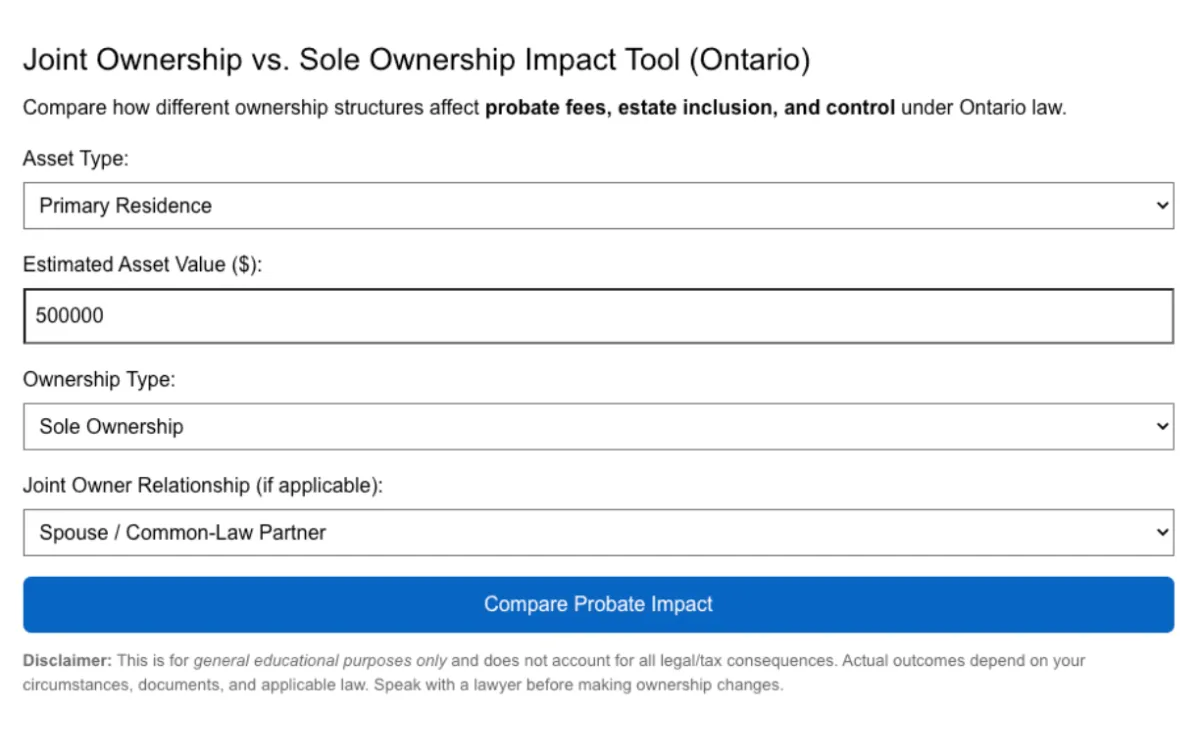

Joint VS Sole Ownership

Compare the probate and inheritance implications of owning property jointly versus solely in Ontario. See how your choice affects estate costs and timelines.

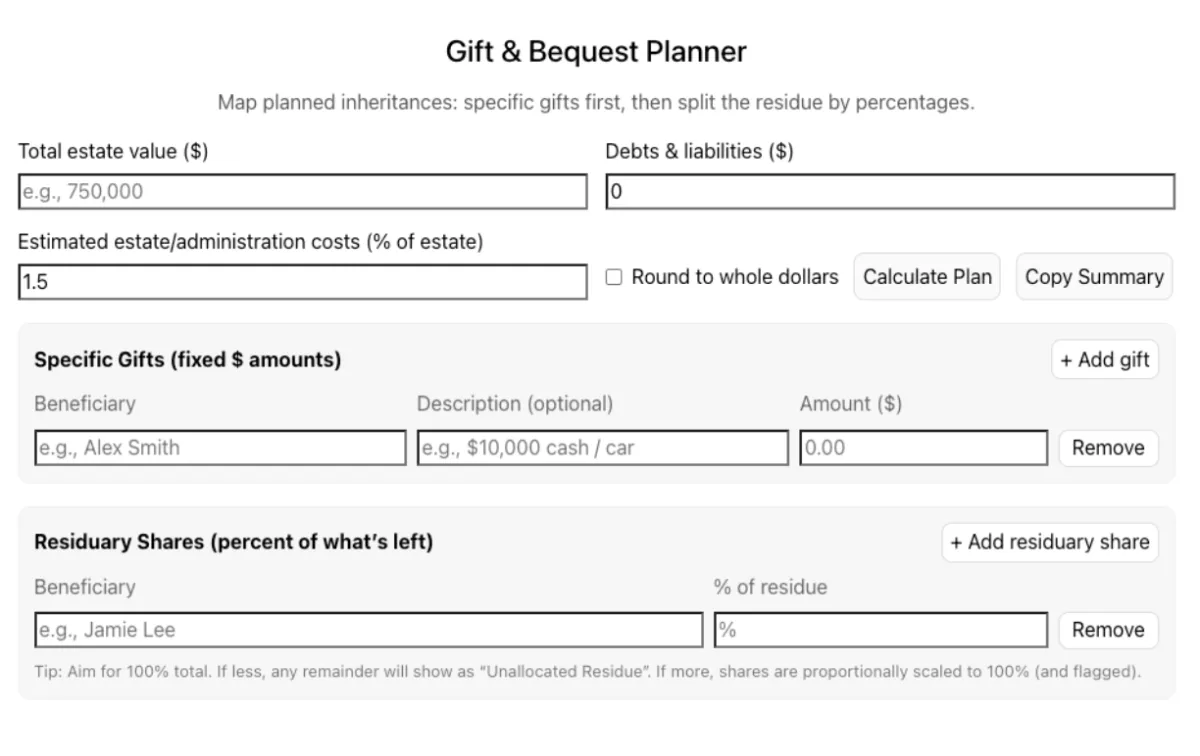

Gift & Bequest Planner

Plan your gifts and bequests with ease. Map out who gets what, keep your records organized, and ensure your wishes are clear and easy to follow.

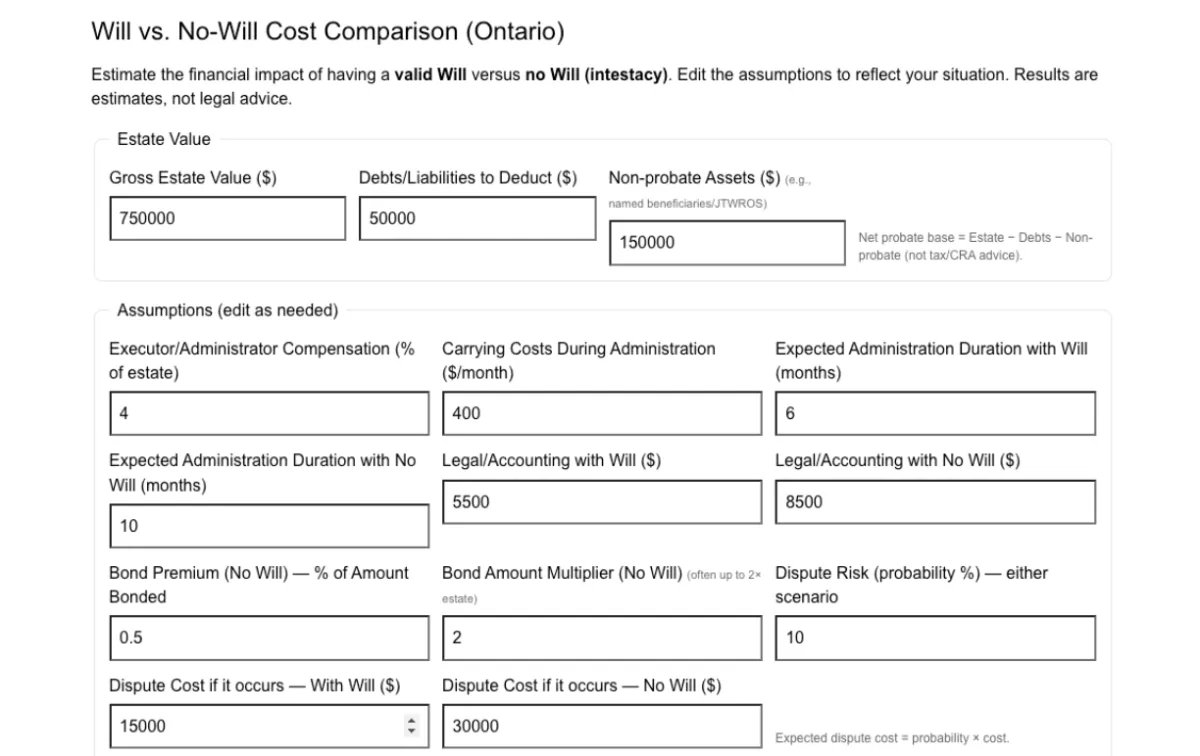

Will VS No Will Comparison Tool

Discover the real cost of passing away without a will in Ontario. Compare legal fees, probate costs, and delays between having a will and not having one.

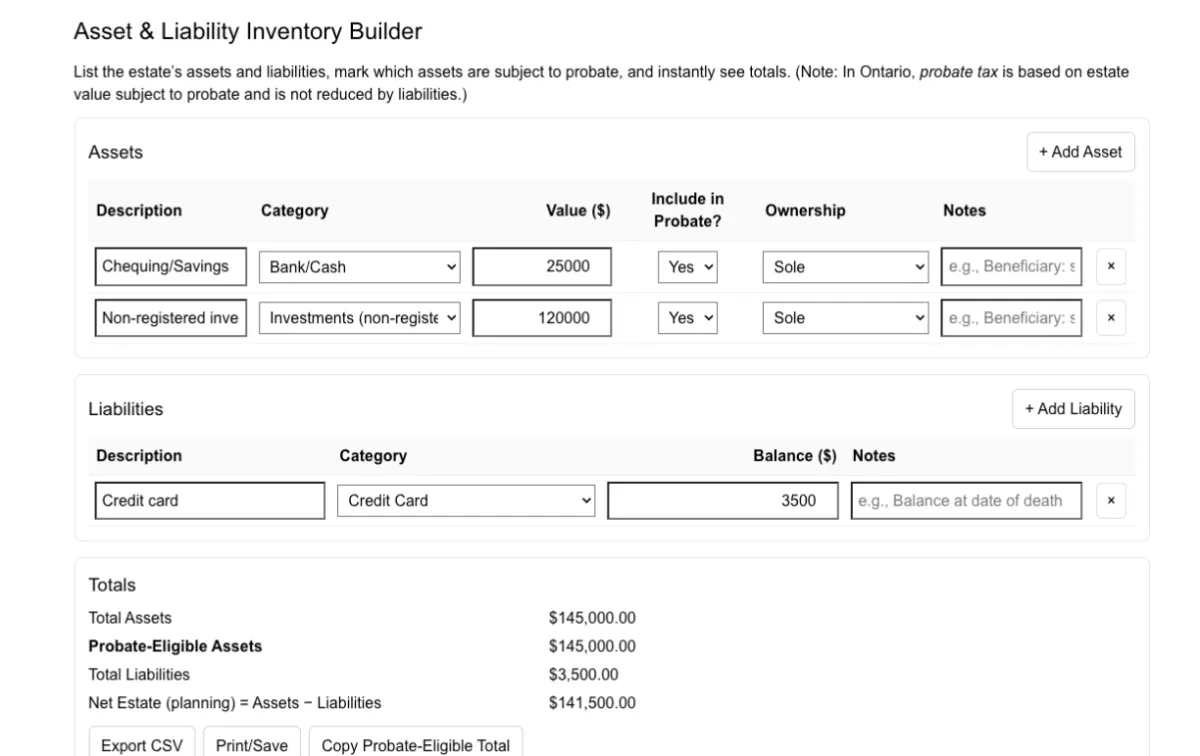

Asset & Liability Inventory Builder

Build a complete, organized list of assets and debts for your estate in minutes. Export a clean record for probate, insurance, and executor reporting.

Sources

Wills & Estate Planning Tools

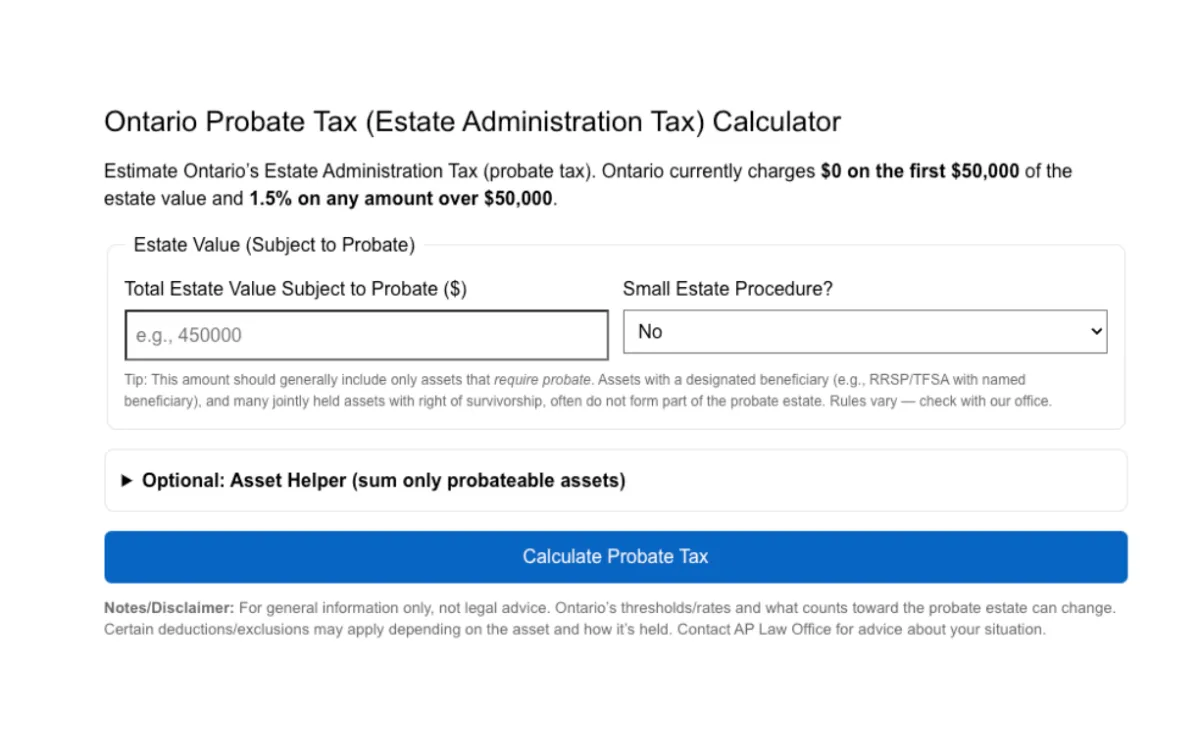

Probate Tax Calculator

Instantly estimate Ontario’s probate (Estate Administration Tax) based on your estate value. See what you’ll owe and plan ahead to reduce fees where possible.

What is probate tax in Ontario?

Probate tax, officially called the Estate Administration Tax, is a fee paid to the province to validate a will and confirm the executor’s authority to act.

How is probate tax calculated?

It’s based on the total value of the deceased’s estate, using Ontario’s set rate structure. The calculator uses your inputted estate value to estimate the tax.

Can probate tax be reduced?

Yes. Proper estate planning, joint ownership, and beneficiary designations can reduce the value subject to probate.

We strive for Customer Satisfaction. Coming from in-depth understanding of the law and the industry, capitalizing on extensive experience, we provide hands-on advice that speaks the language of our client’s needs. No matter if your case is large or small, we treat your matter with importance, integrity and hard work, your success is our satisfaction.

Contact Us

(Local | Toll Free | Email)

Local

905 - 266 - 2633

Toll Free

Email

[email protected]

Our Addresses

(Vaughan | Toronto | London)

Toronto | Mississauga | Brampton | Vaughan | Hamilton | Markham | Oakville | Burlington | Kitchener | London

This site is not legal advice. We occasionally use content and information that is prepared by AI. Including but not limited to technology from Gemini, Chat GPT, Grok, Canva, and other technologies from Open AI. Always consult with a lawyer regarding specific legal questions and advice. Give us a call at 905-266-2633 to set up a consultation

Copyright © 2025 Pranzitelli Law Firm | All rights reserved

Powered By Systems By Orukana

We strive for Customer Satisfaction. Coming from in-depth understanding of the law and the industry, capitalizing on extensive experience, we provide hands-on advice that speaks the language of our client’s needs. No matter if your case is large or small, we treat your matter with importance, integrity and hard work, your success is our satisfaction.

Contact Us

(Local | Toll Free | Email)

Local

905 - 266 - 2633

Toll Free

Email

[email protected]

Our Addresses

(Vaughan | Toronto | London)

Toronto | Mississauga | Brampton | Vaughan | Hamilton | Markham | Oakville | Burlington | Kitchener | London

This site is not legal advice. We occasionally use content and information that is prepared by AI. Including but not limited to technology from Gemini, Chat GPT, Grok, Canva, and other technologies from Open AI. Always consult with a lawyer regarding specific legal questions and advice. Give us a call at 905-266-2633 to set up a consultation

Copyright © 2025 Pranzitelli Law Firm | All rights reserved

We strive for Customer Satisfaction. Coming from in-depth understanding of the law and the industry, capitalizing on extensive experience, we provide hands-on advice that speaks the language of our client’s needs. No matter if your case is large or small, we treat your matter with importance, integrity and hard work, your success is our satisfaction.

Our Addresses

(Vaughan | Toronto | London)

Vaughan

4370 Steeles Avenue West, Suite 16

Vaughan, On L4L 4Y4

Toronto

18 King Street East, Suite 1400

Toronto, On M5C 1C418

London

341 Talbot St, Suite 333

London, ON N6A 2R5

Contact Us

(Local | Toll Free | Email)

Local

905 - 266 - 2633

Toll Free

1-844-757-HURT

Email

[email protected]

Toronto | Mississauga | Brampton | Vaughan | Hamilton | Markham | Oakville | Burlington | Kitchener | London

This site is not legal advice. We occasionally use content and information that is prepared by AI. Including but not limited to technology from Gemini, Chat GPT, Grok, Canva, and other technologies from Open AI. Always consult with a lawyer regarding specific legal questions and advice. Give us a call at 905-266-2633 to set up a consultation

Copyright © 2025 Pranzitelli Law Firm | All rights reserved